Hi everyone,

my IVA started July 2017, currently 2 years in 3 years remaining as no equity release. currently paying £280 per month.

currently i live at home with my parents, however soon they are going to be selling the house and moving to Spain.

they've both just, cashed in there pensions. at the minute i pay £500 a month for board and towards bills

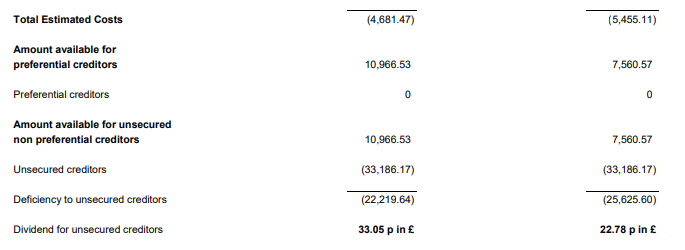

so with my mam and dad moving to Spain i would have to start renting, after looking for a flat the cheapest rent i can find for a 1 bedroom flat is £450 per month with bills on top its about £700. this would mean i would only be able to afford about to pay about £100 a month at most. because of this my mam and dad have offered to pay my IVA off, however I've spoke to vanguard for some advice and they aren't able to give me much of an idea of how much to offer.

My Mam and dad can give me around 6.5k. The total amount of payments remaining on IVA would be £280 x 36 = £10080.

is there any chance they would accept this?

These are the current creditors included in my IVA, I don't know if anyone has had experiences of dealing with them and the likelihood of them approving and offer.

Max Recovery £ 2,614

Max Recovery £ 5,059

Pra Group Uk £ 5,007

Pra Group Uk £ 262

Capital One £ 1,440

Vanquis Bank Limited £ 3,393

Arrow Global LTD £ 2,696

Myjar £ 1,408

Tti-Finance £ 2,519

Tsb Current Account £ 2,786

reason for asking if i feel guilty my mam and dad giving me money when it was my fault i got in this situation and ideally the lower offer they would accept the better.

i don't know if they would take into account circumstances, because really an offer would be the most beneficial for all parties involved. would either be 36 x£100, me going bankrupt or taking the offer.

probably just rambled a bit here not good at explaining things, hopefully it makes sense, any help would be much appreciated.

IVA Started 07/07/2017

F & F Accepted 06/09/2019

Completion Certificate 16/12/2019